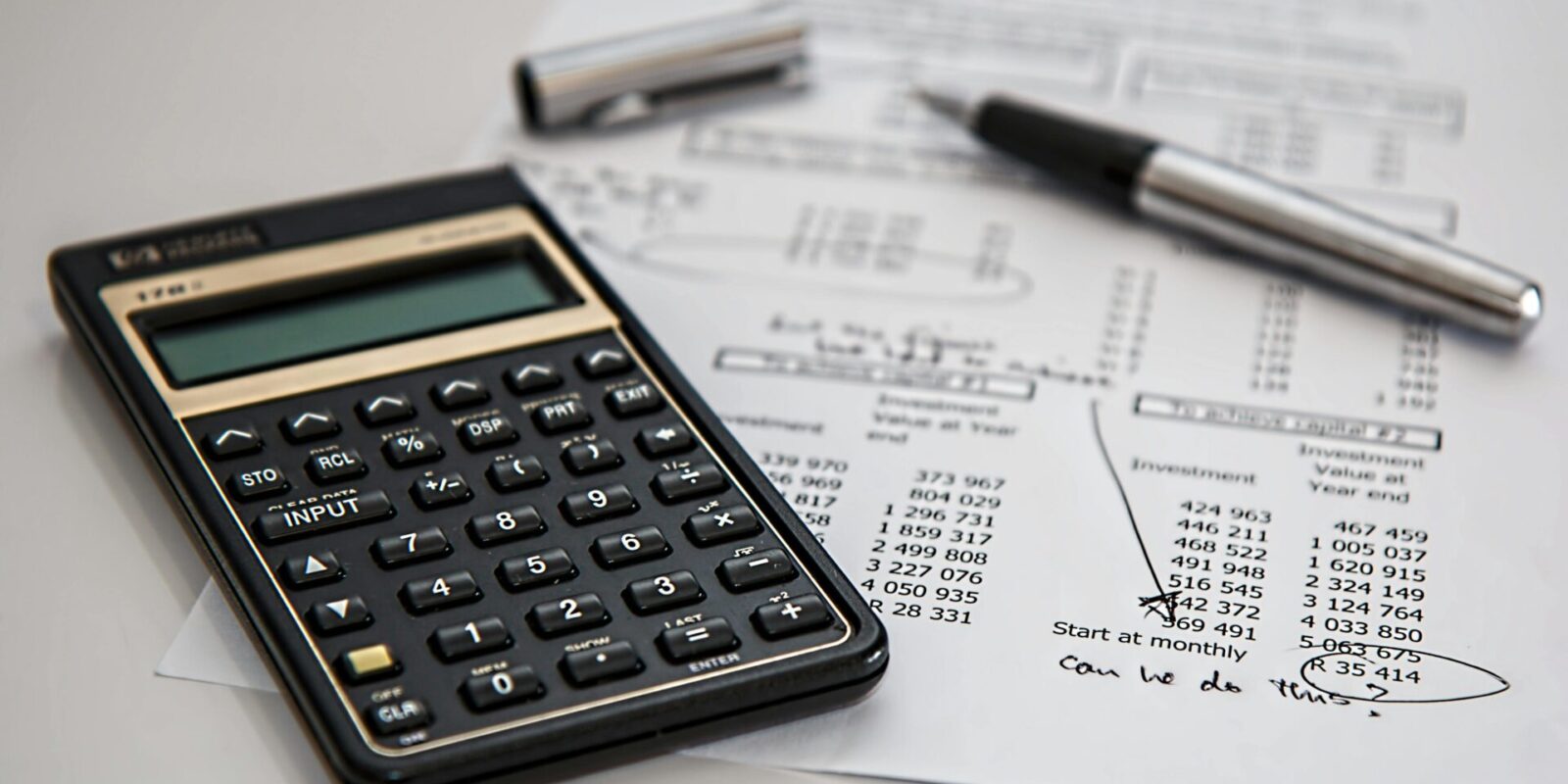

Financial Wellness can be just as important as the other pillars of wellness. As humans living in today’s world, we need to accept that being financially well off can take huge amounts of stress off other areas in our lives. This leaves us room to focus on our other components of well-being.

Financial Wellness can be just as important as the other pillars of wellness. As humans living in today’s world, we need to accept that being financially well off can take huge amounts of stress off other areas in our lives. This leaves us room to focus on our other components of well-being.

It’s no secret that money problems are one of the major daily stressors. Money is one of the main reasons for divorces and family feuds. Many parents, while feeling ashamed or uneasy about the subject, never taught financial lessons to their children. Leaving numerous kids to grow up, make mistakes, and learn lessons surrounding money the hard way.

Finances can make people super uncomfortable. Society tends to equate the level of money someone makes with their value as a human. In reality, all having money correlates to is that someone is either really good at making money, is an expert in a certain field, or was born into a certain family.

At the end of the day, any career or education level can become an expert in money matters. All it takes is being brave enough to face your money head-on and find a way to make it work for you.

Scarcity-

There never seems to be enough money to tackle all of your daily expenses. Whether you have large sums of debt from school or other ventures, have a knack for impulse shopping, or have no idea where all your money goes. Especially now, the prices of homes, rent, food, gas, etc, have all skyrocketed while incomes haven’t increased as dramatically.

After COVID-19 led numerous different types of industries and pocketbooks to suffer, it’s more important than ever to gain some sort of financial literacy. This way, you can prepare for whatever life throws at you.

Below, we’ll go over some simple steps to help you tackle your money woes and make your money work for you. Financial wellness is an important component of your overall well-being. When you can gain control over your financial wellness, you’ll lower your daily stress and anxiety level,s leaving you to enjoy your days.

Track Spending–

Do you ever feel like you don’t spend a ton of money but still have no idea where it goes? A simple task that will bring about an “ah-ha” moment for you is to begin to track your spending. Aim to use a card and deposit any cash you receive so that it’s easier to look back on any purchases you’ve made.

Do you ever feel like you don’t spend a ton of money but still have no idea where it goes? A simple task that will bring about an “ah-ha” moment for you is to begin to track your spending. Aim to use a card and deposit any cash you receive so that it’s easier to look back on any purchases you’ve made.

Start at the beginning of the month, and write down every single purchase you make and every expense you have throughout the month. Maybe you eat out at restaurants often, stop at a coffee shop every morning, or Uber a few times a week when you can realistically walk. Do this for a few months so that you notice any spending habits and trends.

Although you might think that your spending habits aren’t that bad, when you brush through them with a fine-tooth comb, you can accurately see where your funds are being allocated. Begin to question yourself on where you can cut back. What are necessities, money suckers, and what simple pleasures bring you joy that you aren’t willing to give up?

Take A Look-

How many times have you avoided opening your bank statement or banking app because you couldn’t bear to look? Unfortunately, the less you have an idea about what’s going on, the more likely you are to overspend and/or not tackle any debts or important bills.

As much as it might sting at first, rip it off like a Band-Aid. Make it a habit to check your accounts regularly. When you can see for yourself how much money you do or don’t have, you can spend accordingly.

Investing in your financial wellness will involve some tough pill swallowing. If you have any debts, then you need to know exactly what you owe and come up with a plan to pay it off. Maybe it will take a few years, but that’s okay. Figure out a number that you can put towards your debts every week or two to slowly reduce the amount.

Cut Back-

Cutting back might seem like a combination of living on a diet of rice and beans, ramen noodles, and turning your heat off for the winter. Unless you’re really pinching pennies, it doesn’t have to be quite that intense.

Cutting back might seem like a combination of living on a diet of rice and beans, ramen noodles, and turning your heat off for the winter. Unless you’re really pinching pennies, it doesn’t have to be quite that intense.

Brainstorm areas that you’re spending money on that you could realistically live without. Take some time to consider the things that bring you joy. Also, consider the things that wouldn’t bother you much to give up.

There are typically always a few things in our spending habits that don’t need to be there. When you cut back on things that don’t bring much value to you, you wind up with more money in your accounts for the things you truly love and value.

If you’re someone who gets enjoyment from cooking home-cooked meals but is constantly eating out, you’re robbing yourself of your passion and spending money unnecessarily.

If you love traveling but can never afford vacations because you spend too much buying clothes or designer handbags that you’ll only wear once or twice, then re-evaluate what you actually desire. Taking control of your finances is not necessarily giving up all the things you love, but rather spending money on things that you value while cutting back in other ways.

Budget-

If you haven’t already, it’s in your best interest to begin a monthly or weekly budget. Set a certain budget based on your bills, needs, and wants. Keep it realistic but not overindulgent. You might not stay under your goal budget for the first month or two; it will take some practice and adjustments.

If you haven’t already, it’s in your best interest to begin a monthly or weekly budget. Set a certain budget based on your bills, needs, and wants. Keep it realistic but not overindulgent. You might not stay under your goal budget for the first month or two; it will take some practice and adjustments.

Use your monthly spending tracker to gauge your monthly costs and what a realistic budget would look like. When you don’t give yourself a budget to stay within it can turn into “treat yo self” here and “treat yo self” there all year long.

Worth Your Time–

A good way to look at making purchases is not by how much it costs but by how much of your time it’s worth. Let’s say you want to buy a brand-new pair of shoes for $200. How many hours of work will you have to do to be able to afford those shoes? Let’s say you make $20 an hour, that’s 10 hours of work, and longer than an average workday. How bad do you want those shoes? Is it worth it to you?

For the most part, when making an income, you’re exchanging your time for something, regardless of your career. Start to reframe purchases around the cost of your time instead of the cost of the item. This could lead you to dive even deeper into what purchases are actually worth it to you and your time.

Start Saving-

It’s extremely wise, especially with what we’ve learned during the pandemic, to build up a little or big savings fund. A good rule of thumb is to start with $1000 and then work your way up to 3, 6, 9, or 12 months’ worth of expenses. The amount is up to you, what you can realistically save, and how much security you feel you need.

It’s extremely wise, especially with what we’ve learned during the pandemic, to build up a little or big savings fund. A good rule of thumb is to start with $1000 and then work your way up to 3, 6, 9, or 12 months’ worth of expenses. The amount is up to you, what you can realistically save, and how much security you feel you need.

You never know what can happen. It’s smart to start building up a savings fund so that you’ll be ready and equipped for whatever surprises the universe has in store.

Side Hustle-

In today’s age, having just one source of income might not be enough for you. Depending on where you live and the kind of lifestyle you have. Many people need to get a second job or start some kind of side hustle. Thankfully, the possible ways you can bring in extra income are endless.

In today’s age, having just one source of income might not be enough for you. Depending on where you live and the kind of lifestyle you have. Many people need to get a second job or start some kind of side hustle. Thankfully, the possible ways you can bring in extra income are endless.

If you don’t have one already, brainstorm some side hustle ideas. Having extra income coming in can be used for your “fun” money, while your first income goes towards bills, necessities, and savings goals.

Have Fun-

Taking care of your financial wellness might seem boring, but it doesn’t have to be. Have fun taking control of your finances. Be proud of yourself whenever you hit a savings goal, pay a little off your credit card debt, or invest in your retirement. While it might be daunting at first, the better you become with your money, the more fun you’ll learn to have.

Don’t forget, you can still indulge now and then in the things that bring you happiness while learning to cut corners in other areas. Don’t try keeping up with the Joneses. Do you actually like that car, house, or outfit, or is it the latest trend? Don’t be afraid to be original!

Final Thoughts-

As much as money isn’t everything, it’s one of the most stress and anxiety-inducing topics for a good chunk of the world’s population. To increase your overall well-being, being financially literate and secure can take a huge weight off your shoulders.

Getting a handle on your money matters takes some simple yet effective steps to be able to make your money work for you. Track every dollar you spend for the month to see where exactly your money is going. Don’t be afraid to check your account regularly so that you can see what amount you’re working with.

Cut back on certain areas that you can live without to leave room for the things you actually value. Begin to budget and give your dollars a purpose and intention so that they aren’t being frivolously tossed around. Start to save up an emergency fund that is realistic for you so that you’re prepared for any of life’s curveballs.

Finally, get a second job or side hustle, which can bring in disposable income to throw towards life’s pleasures or financial goals. Oh, and don’t forget to have fun with it!

By using the ideas listed here, you’ll begin practicing financial wellness. This will bring you less stress and anxiety and more peace and tranquility when you think about your money.

At first, finance and wellness seem like they don’t belong in the same sentence, but with so many personal and relationship issues stemming from financial problems, getting on track financially can save you huge headaches, leading to greater emotional, mental, and physical well-being.